Because those of us who have to buy our own healthcare need all the info we can get … here’s my tutorial on how to buy an affordable plan that you can actually use.

I’ve been buying my own health insurance since 2009 — pre-Obamacare, when you had to just row on up to some Titanic-sized healthcare giant in your tiny little boat and wave your flashlight around, hoping they would acknowledge you.

The healthcare marketplace at HealthCare.gov has made it easier. But it’s still confusing and intimidating. So let me hold your hand through this and get you covered. Because absolutely no one should be without healthcare.

DO NOT BE AFRAID

The first thing to know is that yes, this can be maddening at times, but if you have any reasonable amount of intelligence, you can do this. I do NOT recommend going to a healthcare broker before trying this yourself. Most of the people I know who go to brokers end up with coverage they don’t like. (My personal opinion. Sorry, brokers.)

Believe in yourself, reader!

My actual costs for 2020

Right now, I’m in the process of shopping for coverage for next year. I logged on to Healthcare.gov to see what my options were for next year. After wading through a bunch of high-deductible plans, here’s what I found.

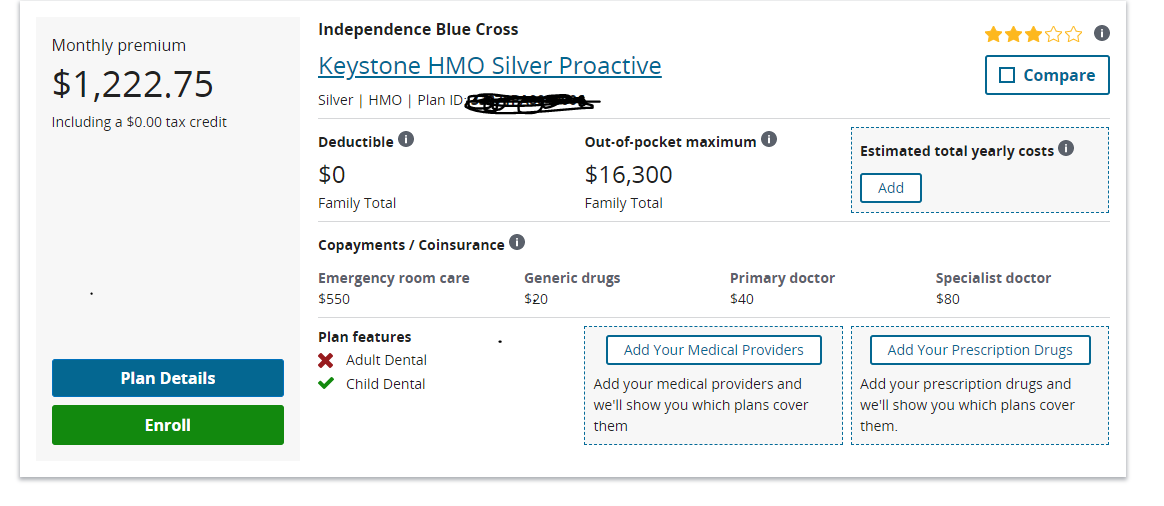

This is the plan that I would be selecting for myself and my husband Joe. That’s for two adults and no kids and with no subsidy. This is also in Bucks County, PA. Different plans are available in different regions, but you can use our costs as a reference.

Why do I like this plan? No deductible. So important. This is the same plan I’ve been on for years and it’s pretty much fine. It’s $550 to go to the ER, but it’s only $100 to go to urgent care, so I can live with that. I go to the doc a few times a year. I see my gyno. I get bloodwork and mammograms and prescriptions. I have various copays for various things, but nothing that makes me want to scream (or at least scream loudly).

Again: It’s fine.

However, we will be renewing directly through IBX because, for some reason, it’s cheaper. Our total costs there will be in the ballpark of $950 for the two of us. Also, Joe’s plan is generally more expensive than mine. Call it the “dude premium, I guess.

So that us. Now let’s talk about you.

My top tips on how to shop for health insurance

Having done this for sooo many years now, here is what I would tell anyone:

1. Always go to healthcare.gov and work through all the questions. It’s always worth seeing if you can save some money or qualify for a subsidy to reduce your monthly costs. HOWEVER, be aware that if your income fluctuates, if you withdraw money from your retirement account (even if it’s a hardship withdrawal), or if someone drops a bag of money on your front porch, you may have to pay back your subsidy in April.

2. Shoot for plans in the “silver” range. These are designed for regular use without the high monthly premiums of the “Cadillac” plans. (Although, yes, all the premiums seem high. But they could always be higher.)

3. Be sure to evaluate your total costs, not just your monthly premium. Think about how you will use the plan. Do you need a lot of tests? Do you have to see specialists? How many prescriptions do you get and are they generic? Take the time to factor in your usual yearly use of the plan. There is a calculator on healthcare.gov to help you with this. There is also a “plan details” button for each plan. Open it. Read it. It will tell you how much you’ll pay for things like lab tests, x-rays, etc.

4. Avoid high deductible plans unless you hardly ever need medical care. With these plans, you may have lower monthly costs, but you’ll pay a fortune the first time you need to go to the doc or the pharmacy.

5. It’s always worth calling the major health insurers and getting a direct quote. Sometimes it’s cheaper. And if you like the plan I mentioned above, I would ask for it by name when calling IBX. (The number is 1-844-GET-IBX1.)

Are marketplace plans better or cheaper?

The healthcare marketplace (created under the Affordable Care Act, a.k.a. Obamacare) can be a lot cheaper if you qualify for a monthly subsidy. Your eligibility is determined by your income (and your partner’s) and the number of people in your household.

You can find out if you qualify by working through the first few questions on healthcare.gov. Within the first few steps you’ll be prompted to answer a few qualifying questions.

The marketplace should also be your first stop if you have a pre-existing condition. There, you cannot be refused coverage for any medical conditions you currently have. Insurance companies, however, MAY refuse to cover if you call them directly as an independent human, instead of applying as part of group coverage.

Best of luck!

Thank you for attending my TED Talk.

Leave a Reply